Home Loan, Personal Loan & Business Loan Consulting Services in Delhi

Being the capital of the country, it inhabits the people from all over the country. So, it has a mixed culture and represents the culture of all Indian regions. Politically also the important decisions are taken and various policies are passed. The city has a great and impressive history which stands out the city among others.

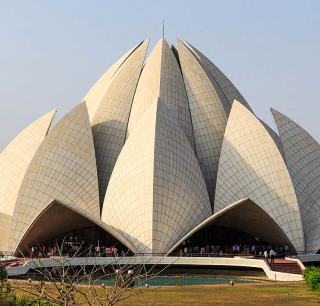

Delhi is known for its perfect blend of traditional and modern lifestyle. Delhi has a major attraction in terms of fair and festivals. The major festivals celebrated in this city are Lohri, Holi and Diwali. The culture of the city is also influenced by the neighboring states like Uttar Pradesh, Haryana, Punjab and Rajasthan. The diversity of the city makes it lively and colorful and displays the architecture of north and south India, Indo-Persian and Bahai.

In Delhi, Mudra Home has been on a remarkable journey from last 3 years. The financial consulting company is working with all the Banks and NBFC’s in Delhi/ NCR and has developed a huge clientele from the neighboring states like Uttar Pradesh, Haryana and Punjab. The team has a team that works dedicatedly to help you to get any kind of loan as per your requirement.

The diligent team members always try to work as per your convenience. They are always ready with a financial plan to guide you with your financial aspects. They understand your need and always suggest you the best possible and available options in the market. Their personal one-to-one meetings with the customers develop a bridge of dependability, trust, belief and conviction among them. As they understand your need of loan so as the required documents. The team members are 24×7 ready to guide their customers about the required documents for the particular financial product. Yes ofcourse, a pre check of all the documents is done by the team of Mudra Home before moving further with the process with any of the Bank/ NBFC or any other financial institution.

The company provides consulting for Mortgage Loan, Home Loan, Business Loan and Personal Loan. Similarly the documents, the criteria for the eligibility is also being checked before taking a step ahead for the loan process. The documents for all the loans are different, other than the basic KYC’s and if any extra document is required than it depends on the case. Since, a document is a presentation of information given in a recorded form. Let’s read ahead about the different loans and their documents required by the team of Mudra Home, Delhi.

Home Loan In Delhi

Home loan can be borrowed to buy a new or a resale property. It is a secured loan which means that the borrower has to keep the property as a security against the loan with the Bank/ NBFC. The Home loan tenor can be exceeded for a maximum 25 – 30 years and minimum of 1 year. The documents and the eligibility criteria are different for both salaried and self employed. Mudra Home in Delhi has a separate team to find and work to understand the requirement for home loan customers. While consulting the Home loan customers the sales team asks them about their need and accordingly guide about the required documents. The required documents for the financial product are:

- Duly filled form with an attached photograph

- Identity proof

- Address proof

- IT Returns / Form 16 for the last 3 years

- Bank Statement for last 6 months

- Salary Slip / Certificate

- Educational certificates

- Agreement to sale for purchase of property

- Copy of all the approved plans, chain linked documents and title documents of the property

- Details of all current and closed loans

Personal Loan in Delhi

A loan that can be used for personal as well as professionally without disclosing the details of its expenditure is a personal loan. The financial product is so flexible that the borrower is free to use it in any manner and also not bound to disclose the details of expenditure to the lender. A personal loan is an unsecured loan and does not involve any security to be kept with the Bank. Due to the uncertainty of its refund, a high rate of interest is charged. The documents for salaried and self-employed are different other than the basic documents such as

- Duly filled application form

- Identity proof

- Address proof

- A cheque as a processing fee in favor of the institution

- Self attested documents.

Other documents for salaried are

- 2 years form 16 / ITR

- Qualification Certificates

- Latest 6 months Bank statement

- Salary slips for 3months

- Job continuity proof for last 2 yrs

Other documents for self employed are

- Official address proof

- Proof of business continuity for 3 yrs

- CA certified financials for last 3 yrs

- Bank statement of 1 yr

- Details of all closed and running loan amounts

Loan Against Property (LAP or Mortgage) in Delhi

Loan Against Property involves a collateral to borrow a loan amount. It is a secured loan where the property is kept with the Bank/ NBFC as a security for the loan borrowed. Similar to personal loan, this loan amount can also be used for different purposes such as any medical emergency, higher education, marriage or an expensive dream vacation. The tenor of loan against property can be upto 15 years with minimum of 1 year. The profession of the borrower is the first eligibility criteria before moving further with the process. The document differs from salaried to self employed (apart from basic documents also known as KYC). Let’s understand the different documents required for LAP:

- Duly filled form with an attached photograph

- Identity proof

- Address proof

Other documents required from salaried professionals

- IT Returns/ Form 16 for the last 3 years

- Bank Statement for last 6 months

- Salary Slip / Certificate

- Educational certificates

- Copy of all the title documents of the property, chain linked documents and approved plans

- Details of all current and closed loans

Other documents required from self employed professionals

- Address proof of business premises

- Business continuity proof for 3 years

- CA certified financials for last 3 years

- Bank statement of last 1 year

- Service Tax Returns/ VAT of last 1 year

- Provisional financial years of the current year

- Details of all current and closed loans

- A cheque of the processing fee in favor of the financial institution

- Copy of title documents of the property, approved plan and chain linked documents

Business Loan in Delhi

Business loan is borrowed to keep the functioning of business smooth. The funds are used for the rotation of the routine business expenses. Similar to personal loan, Business loan is also an unsecured loan but yes it can easily be converted to a secured loan to avail better deal and negotiate on better terms and conditions. The team in Delhi is quite focused to cater the self employed professionals and help them to develop more. The documents to avail a business loan in Delhi are as follows:

- Duly filled application form with a photograph

- Identity proof

- Residential proof

- Address proof of business premises

- Business continuity proof for 3 years

- CA certified financials for last 3 years

- Bank statement of last 1 year

- Service Tax Returns/ VAT of last 1 year

- Provisional financial years of the current year

- Details of all current and closed loans

- A cheque in favor of the financial institution as a processing fee

Delhi is not only a biggest commercial centre in North India but also provide a space for the development of small scale industries. Delhi is a cosmopolitan state where people embrace new ideas and lifestyle. From the business point of view, Delhi is suitable for kind of loans. All the above loans fit in some or the other borrower’s kitty. It has a vast network of Banking facilities and a great infrastructure that provides livelihood to the local as well as the outsiders from other cities.